Abstract

Ethereum underwent a major upgrade named Fusaka on December 3, 2025, marking its third milestone update since The Merge and the Dencun upgrade. This upgrade aims to significantly enhance network scalability, reduce transaction costs, and optimize node operational efficiency, with a key focus on upgrading and optimizing Account Abstraction (AA) related functionalities. Account Abstraction (AA), as a major upgrade to Ethereum's account system, is designed to address the fundamental security and user experience bottlenecks of the "private key equals account" model in the EOA era. It endows on-chain accounts with modern capabilities such as programmability, recoverability, and permission control. The implementation of ERC-4337 has accelerated the formation of the smart account ecosystem. However, challenges like high costs, unclear business models, ecosystem fragmentation, and cross-chain limitations have resulted in an adoption process that is "technologically advanced but promotionally lagging." With Rollups reducing costs, BLS signature aggregation, and EIP-7702 providing a seamless upgrade path, AA is gradually entering a stage of scalable application. In the next five years, AA will become the "high-end intelligent layer" for on-chain accounts but will not replace EOAs. Instead, it will coexist with interoperability protocols like x402, jointly propelling Web3 from a geek-centric phase to a mass adoption era and laying the foundational hub value for a unified internet account system.

I. The Development History and Comprehensive Capabilities of AA Accounts

Ethereum underwent a major upgrade namedFusakaon December 3, 2025, marking its third milestone update since The Merge and the Dencun upgrade. This upgrade aims to significantly enhance network scalability, reduce transaction costs, and optimize node operational efficiency, with a key focus on upgrading and optimizing Account Abstraction (AA) related functionalities. Within Ethereum's architecture, the evolution of the account structure actually constitutes the core logic behind the entire on-chain user experience, asset security, and even industrial upgrading. The dual-account system of EOA (Externally-Owned Account) and CA (Contract Account), familiar today, is a technical legacy from Ethereum's launch in 2015. However, during the 2023–2025 period, as user scale surpassed tens of millions and Web3 gradually shouldered the role of asset custody and user operation infrastructure, this system revealed increasingly severe structural bottlenecks. These bottlenecks not only limit industry scaling but also constrain user growth and the落地 (landing/implementation) of real applications. The emergence of Account Abstraction (AA) aims precisely to address the inherent structural flaws of Ethereum's account system, enabling the on-chain world to possess "modern financial-grade" security, experience, and autonomous capabilities, ultimately becoming a trustworthy asset infrastructure for global users. The core reason for the current system's bottlenecks lies in the fact that EOA hardcodes the security model of "private key = assets" at the protocol底层 (bottom layer/underlying layer). This model is工程上 (engineering-wise)简洁 (simple/concise), but in practice, it constitutes the biggest阻力 (obstacle/hindrance) to规模化 (large-scale) adoption.

The operational structure of an EOA is like a "mechanized assembly line," rather than the "one-click execution" familiar to modern internet users. Furthermore, in terms of permission control, EOA is completely incapable of implementing any细粒度 (fine-grained) settings: it cannot set daily limits, define multi-signature rules, create parent-child accounts, freeze partial permissions, nor enable automated strategies. An EOA is like a master key containing all assets and all permissions; if leaked just once, all assets and permissions are exposed.

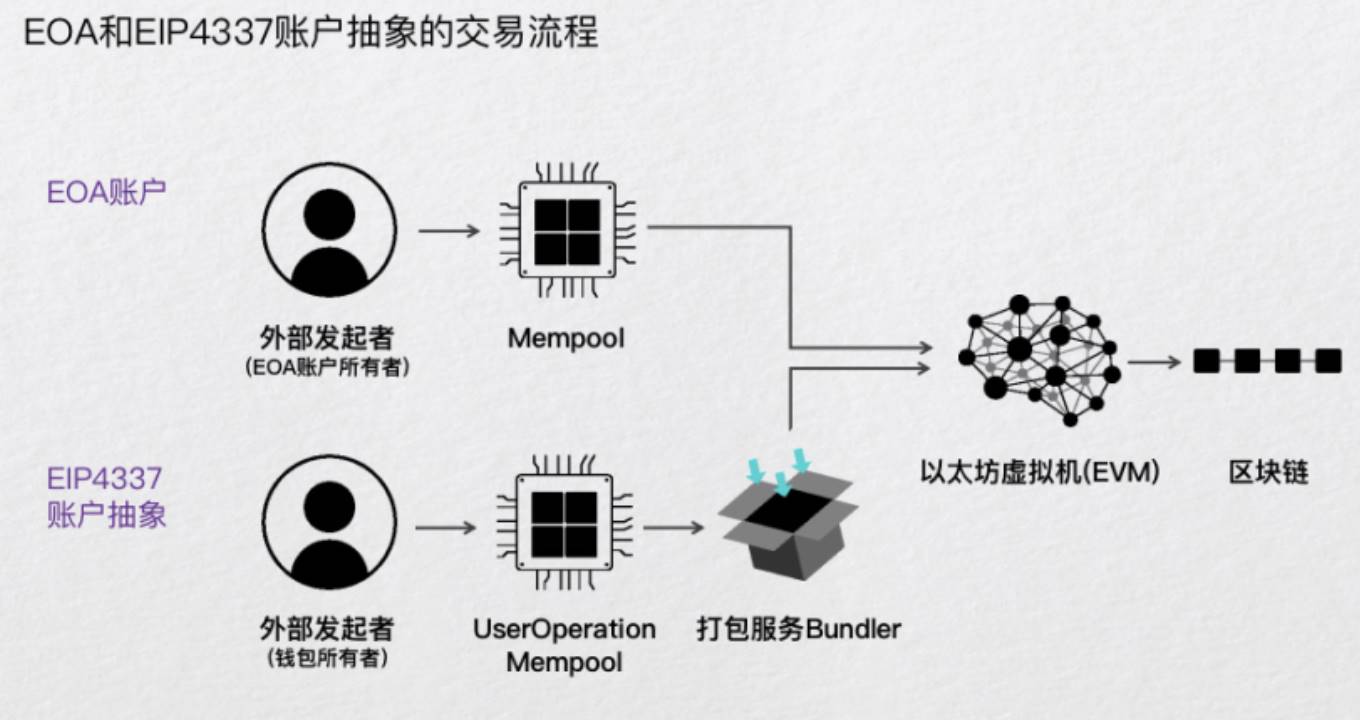

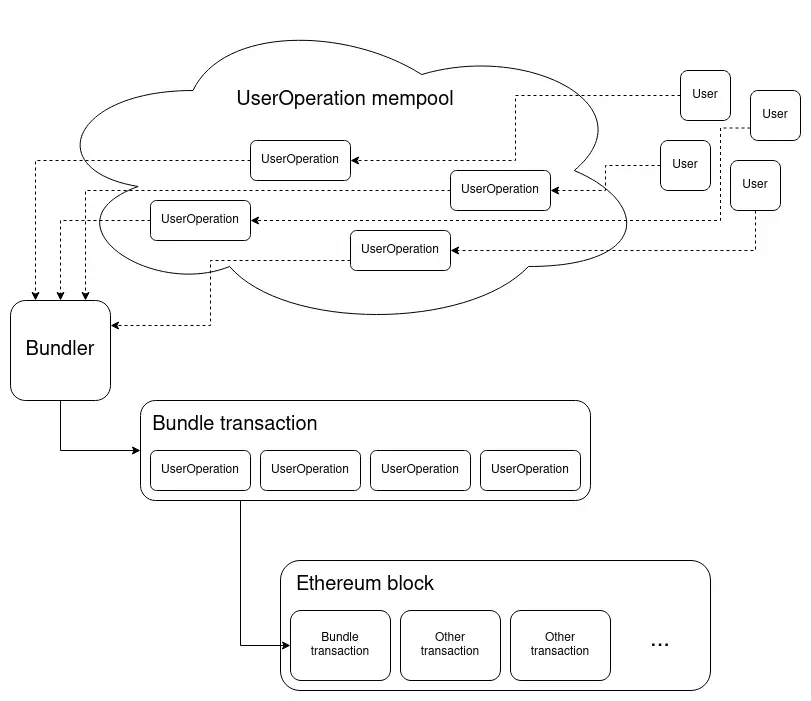

Consequently, the Ethereum community began to rethink the question of "what an account should be," and the concept provided by AA addresses this precisely: an account should be "code," not a "private key." Under the AA paradigm, accounts can be programmed, verified, recovered, and upgraded. In other words, the limitations previously hardcoded into the EOA architecture can be abstracted away. A wallet is no longer just a signature container but can become a "smart account" with logic, strategies, and a permission system. The proposal of Account Abstraction was not achieved overnight but went through a long process of design博弈 (game/contest/negotiation), with core proposals including EIP-86, EIP-2938, ERC-4337, and the latest EIP-7702. Among these, EIP-86 and 2938 required modifications to the Ethereum consensus layer, making them difficult to implement. The brilliance of ERC-4337 lies in its construction of AA as a "parallel system"—by utilizing UserOperation and Bundler, it bypasses the need for underlying protocol changes, enabling AA to be activated seamlessly within the existing Ethereum ecosystem. The architecture of ERC-4337 essentially creates a new channel parallel to the transaction mempool, allowing users to submit UserOperations instead of transactions. These are then bundled, simulated, aggregated by Bundlers, and uniformly sent to the EntryPoint contract for execution. This enables capabilities like contract accounts initiating transactions, batch execution, atomic operations, and multi-signature verification. Although the engineering complexity increases significantly, it is currently the practical path to fully enable AA without a hard fork. During the 2024–2025 evolution, Vitalik proposed EIP-7702, hoping to further naturalize the conversion between EOA and AA, but it still requires完善 (perfection/completion) of the ecosystem support. The significance of AA is not only in solving the structural flaws of EOA but also in bringing "generational leap" capabilities in experience, security, and cost to Ethereum. Firstly, in terms of security, AA enables wallets to have a programmable permission system: users can enable social recovery mechanisms, no longer worrying about losing seed phrases; they can set multi-signature rules for safer fund management by families, institutions, or DAOs; they can create parent-child accounts, whitelists, spending limits; they can even freeze certain permissions or use temporary keys, increasing flexibility in usage scenarios. The "single point of failure" mode of EOA is彻底抹平 (completely eliminated/flattened) by AA, resulting in an order-of-magnitude improvement in security. In the cost dimension, with the introduction of Paymaster in AA, users can pay gas fees with any ERC-20 token, or even have gas fees sponsored by projects, achieving a truly "fee-less" experience. Furthermore, AA supports batch execution and transaction aggregation, significantly reducing the number of signatures and the cost of failed transactions, thereby markedly lowering the overall cost of complex interactions. In terms of user experience, AA brings Web3 interaction体验 (experience) closer to Web2 for the first time. Users can execute combined operations with one click, without needing to understand cumbersome concepts like nonce, gas settings, or signing order; new users can even create wallets without seed phrases, initializing accounts through biometrics, local recovery, email verification, etc.; complex on-chain logic (such as strategy trading, automated liquidation, timed execution) can be embedded within the account logic, enabling on-chain applications to possess the realizability of "intelligent products."

The ultimate vision of AA is to transition blockchain from an "experimental system for tech-savvy experts" to a "universal account infrastructure for global users." If the bottleneck of Web3 in the past decade came from the primitive model of "key as account," then the breakthrough of Web3 in the next decade will come from the new paradigm of "account as program." AA is not merely an upgrade of wallets but a rewrite of the entire on-chain interaction logic; it not only enhances user experience but also lowers the barrier to development, enabling DApps to design processes, define permissions like Web2 products, and build a trustless security guarantee system at the account layer. With the comprehensive explosion of the ERC-4337 ecosystem in 2024–2025, and the gradual formation of industrial chains like Bundler, Paymaster, AA wallets, and modular security plugins, Account Abstraction is transforming from a "concept" into "infrastructure." Just as the evolution from Web1.0 to Web2.0 on mobile gave rise to super apps and a trillion-dollar industry, the落地 (implementation/landing) of Account Abstraction is expected to become the underlying driving force for Web3's next exponential growth. The limitations of the EOA era are being gradually dismantled, and AA is leading the entire industry towards a safer, more flexible, and more mass-user-friendly on-chain world.

II. The Prospects and Challenges of AA Accounts

Account Abstraction (AA) regained its position as a core narrative in the Ethereum ecosystem during 2023–2025. However, after the initial hype and expectations, the structural challenges it faces have also become apparent. The long-term prospects of AA remain highly anticipated—it promises a generational leap in security, usability, and automated experience, replacing the primitive "private key equals account" model of the EOA era. Yet, at the practical implementation level, the落地 (landing/implementation) of ERC-4337 has been questioned multiple times, perceived as "much thunder but little rain." Viewing from four dimensions—industrial structure, cost model, ecological collaboration, and competing protocols—the prospects and dilemmas of AA are intertwined. It represents the future of the blockchain account system while also exposing the complexity of the protocol upgrade path.

From the cost perspective, the primary阻力 (resistance/obstacle) for AA comes from gas fees. Compared to the 21,000 gas for an EOA transaction, a UserOperation in AA averages around 42,000 gas on the mainnet, almost double. This is not due to waste but is structural: the validation call of 4337 includes validateUserOp, state access for EntryPoint, bytecode reading of the wallet contract, log recording, initCode deployment, and data encoding overhead. Each of these steps implies additional on-chain computation. Theoretically, moving complex logic into contract wallets is the right thing to do, as a true account should be programmable, verifiable, and controllable. However, the expensive resources on Ethereum L1 mean that any design—no matter how elegant—ultimately translates into cost, and cost becomes the strongest deterrent to adoption. Many potential users and projects are thus deterred. In terms of business models, another core component of AA, the Paymaster, faces the problem of unclear ROI (Return on Investment). The Paymaster structure involves projects paying gas fees on behalf of users to gain user growth or沉淀价值 (accumulated/deposited value). However, the issue is that there is no mechanism for projects to clearly calculate the causal link of "paying gas → acquiring new users → retention and conversion." Most wallets or DApps rely on subsidies to attract users initially, but once subsidies disappear, user migration costs are extremely low, making it difficult to form network effects. More realistically, the Web3 ecosystem lacks the industrial chain闭环 (closed loop) found in Web2, such as "advertising, retention, traffic," meaning Paymaster efforts often go unrewarded, and it's challenging to develop a sustainable business model. Therefore, the slow promotion of AA is essentially not a technical problem but a lack of "commercial traction." The market does not pay for concepts; it pays for profits. Ecosystem fragmentation further exacerbates the困境 (predicament/difficulties) of 4337. The full stack of AA includes EntryPoint, Bundler, Paymaster, Wallet Contract, and Aggregator, and different wallet providers and chains may have their own implementations. Due to the complexity of AA's structure, UserOperations are not processed directly by the chain but must undergo simulation and aggregation by Bundlers. This means that slight implementation differences between ecosystems can cause "incompatibility." Incompatibility between wallets, high DApp integration costs, and complex on-chain testing all force project teams to reassess the ROI when considering AA. While EOAs are primitive, they are extremely simple; while AA is advanced, it presents the challenge of "ecological fragmentation" in the early stages of promotion. For the vast majority of small and medium-sized DApps, supporting 4337 does not bring obvious benefits but requires承担 (bearing/undertaking) additional technical costs, resulting in "avoidance if possible."

The lack of cross-chain capabilities also削弱 (weakens/diminishes) the system-level value of AA. ERC-4337 is essentially an account system upgrade for the EVM Layer. It relies on the EntryPoint, UserOp模式 (mode), and EVM's validation logic, making it inherently difficult to extend to non-EVM chains. To achieve a unified multi-chain experience, additional middleware, multiple sets of EntryPoints, repeated validations, and cross-chain message transmission must be introduced, multiplying the cost and complexity. The Web3 world is already fragmented across chains, and AA's inability to form a unified account system across chains prevents it from fulfilling the vision of being the "unified account standard for Web3." A smart account owned by a user on one chain cannot be seamlessly mapped to another chain, significantly reducing AA's potential for规模化 (large-scale) value. However, despite the apparent structural challenges, AA remains a highly promising direction for the future. The reason is that the evolution trends of next-generation blockchain infrastructure are naturally aligning with AA, not diverging from it. Particularly, the large-scale rise of L2s (Rollups) structurally resolves AA's cost pain points. The data compression capabilities of mainstream ZK Rollups and Optimistic Rollups can reduce the gas cost of 4337 by 70%–90%, and batching UserOperations can further降低 (reduce) the on-chain overhead per operation. Therefore, "Rollup + AA" is highly likely to become the mainstream combination in the next 3-5 years, also relieving the Ethereum mainnet from bearing the cost pressure of high-frequency AA operations. Simultaneously, ERC-4337 is continuously evolving, with the most important change being the introduction of the BLS aggregate signature mechanism. By aggregating multiple user operations into a single signature and executing them in batches, the amount of data that needs to be published on-chain is大幅降低 (greatly reduced). This both increases TPS and significantly reduces gas consumption. More crucially, it enhances on-chain transaction throughput, making AA no longer just a "wallet upgrade solution" but a "more efficient on-chain operation protocol." Combined with the compression capabilities of Rollups, the core bottlenecks of AA in terms of performance and cost are being unlocked, and the industry is beginning to see its commercial viability. Additionally, EIP-7702, proposed by Vitalik, provides a "temporary conversion" path from EOA to smart accounts, allowing users to instantly启用 (enable) AA capabilities within a transaction without migrating assets or changing wallets. EIP-7702 significantly reduces ecological friction, enabling wallet providers to upgrade gradually without重构 (restructuring/refactoring) the underlying architecture, allowing users to enter the AA world almost imperceptibly. This is an important turning point: AA no longer needs to "replace EOA" but can coexist compatibly with EOA, achieving ecological migration through gradual evolution.

However, the biggest challenge to AA's future comes from a competitor that突然崛起 (suddenly rose) in 2024–2025—the x402 protocol. Compared to AA, x402 is more like (更像一个) an "internet-level unified payment protocol." It uses HTTP 402 as an entry point, unifying the interface logic for Web2 and Web3 payments. AA aims to solve "intra-chain account abstraction"; x402 aims to solve "internet payment abstraction." AA's target audience is Web3 users; x402's potential audience is the entire internet. More importantly, x402 has a natural commercial闭环 (closed loop): Providers and Facilitators can charge fees directly from the payment flow, possessing clear market traction. Under the x402 framework, ERC-8004 becomes a "tool protocol" rather than an underlying infrastructure requiring full-network migration, making its promotion difficulty much lower than AA's. AA needs to persuade the ecosystem to migrate to its defined system, while x402 chooses to adapt to existing internet habits, giving it a clear advantage in commercial adoption. Therefore, AA's prospects are clear, but the road is rugged (崎岖的). There is a profound tension between technological elegance and industrial reality: the future defined by AA is indeed better, but it must overcome multiple challenges like cost, commercial incentives, ecosystem fragmentation, and competing protocols before realization. As the Rollup era arrives, signature aggregation technology matures, and EIP-7702 opens a compatible path, AA's cost and compatibility issues will gradually ease, while business models and cross-chain capabilities still require further breakthroughs. The key in the coming years lies not in whether AA is more advanced, but in whether the industry finds a path for its "natural diffusion." The future of AA belongs to those ecosystems that can贯通 (connect/pierce through) its "protocol capability → product experience → commercial value," not merely technical implementers. It may not be the easiest solution to promote, but it remains the most promising solution for reshaping the on-chain account system.

III. The Investment Value and Future Outlook of AA Accounts

The role of Account Abstraction (AA) in the blockchain industry is gradually shifting from a "revolutionary technological concept" to a "structural infrastructure upgrade." Its investment value is also evolving from early narrative红利 (dividends/bonuses) to a comprehensive judgment based on engineering implementation, ecological synergy, and commercial sustainability. In the next five years, AA will not become the unified entry point for all of Web3, nor will it replace EOA as the standard account system. However, it will稳固存在 (steadily exist) in the high-end tier of wallets and account systems, becoming the core representative of "smart accounts" and deeply embedded in the on-chain interaction experience and the transaction execution capabilities of the Rollup era. Therefore, for investors, the value of AA is not short-term user explosion, but a "classic internet-style long-term infrastructure investment opportunity."

From a structural trend perspective, AA's status will significantly improve with the普及 (popularization/widespread adoption) of EIP-7702. EIP-7702 allows an EOA to temporarily become a smart account within a single transaction. This means existing wallet systems do not need to be强制迁移 (forcibly migrated), nor do asset structures need to be重构 (restructured). Users can enjoy AA capabilities like permission control, social recovery, multi-signature logic, and automated strategies without changing wallets, copying seed phrases, or migrating assets. This "painless upgrade" model smoothens AA's adoption curve from steep to gradual, giving wallet providers greater incentive to incorporate it into their underlying architecture. Therefore, in the next three to five years, we are more likely to see the coexistence and integration of EOA and AA, rather than replacement.

The true主场 (main arena/home ground) for AA's落地 (implementation) will be within the Rollup ecosystem. As L2s like zkSync, Scroll, StarkNet, and Base become mainstream execution environments, AA's cost pain points will be naturally absorbed by Rollup data compression capabilities, reducing its gas costs by 70%–90% compared to L1. Simultaneously, BLS signature aggregation and batched UserOperations will further reduce on-chain data size, transforming account operations in AA mode from "expensive but advanced" to "advanced and affordable." This implies that the investment value lies not in L1 AA, but in AA wallets, Paymaster, and Bundler infrastructure that deeply embrace Rollups. This direction corresponds to tangible engineering value—it's not a concept but a real adoption driver brought about by actual on-chain cost reduction. From an industrial chain perspective, the investment value of AA is mainly concentrated in four types of infrastructure areas: smart contract wallets, Paymaster service providers, Bundler infrastructure, and L2s that directly support AA. Smart wallets represent the front-end入口 (entry point) for future user experience. Projects like Safe, Argent, OKX Web3 Wallet, imToken (AA version), and Zerodev are the most certain "ecological targets." They achieve the leap from "key wallets" to "smart account wallets" through modular wallet architecture, social recovery, multi-signature, and automated strategies, possessing strong compound user retention capabilities. Paymaster is one of the links with the most potential commercial value in the AA system. It is the bridge between fuel subsidies and user growth. Although the Paymaster business model is not yet fully mature, in richer Rollup environments and on-chain business scenarios, it is expected to become an "on-chain growth engine": projects pay gas for high-value users, implement subsidy strategies, whitelist strategies, thereby creating a marketing effect similar to Web2's "advertising exposure." Projects like Stackup and Pimlico are thus worth watching. Bundler, as the execution layer of AA, is also an infrastructure of隐性价值 (implicit value), equivalent to the "transaction packaging logistics layer" of the blockchain world. Projects like Biconomy and Alchemy's AA Infra will benefit from the growth of the ERC-4337 ecosystem. Bundlers do not have direct user-facing opportunities but have a scalable and deterministic revenue model, potentially becoming an infrastructure investment direction characterized by "low volatility and scale" in the future.

Simultaneously, AA in the next five years must face the competition and complementary relationship brought by the x402 protocol. x402 does not aim to replace AA but rather to become a unified internet payment entry point using the HTTP 402 model. It covers Web2 and Web3, possesses innate cross-chain capabilities, and has a clear commercial闭环 (closed loop) (Provider + Facilitator fee model). Under the x402 framework, ERC-8004 becomes a plugin rather than an underlying protocol, giving it stronger promotion potential. From an investment perspective, AA's value lies in intra-chain account intelligence, while x402's value lies in connecting the entire internet's payment experience. The two will coexist and complement each other in the future, rather than one being the sole winner.

综合判断 (Comprehensive judgment), AA will constitute the "middle-layer infrastructure" of the Ethereum and Rollup ecosystems in the next five years: the底层 (bottom layer) remains EOA (weakened but existing), the中层 (middle layer) is smart accounts (AA), and the顶层 (top layer) is the unified interoperability network of x402. AA users will not experience explosive growth, but its value will steadily increase with the growth of on-chain transaction volume, demand for strategy automation, professionalization of asset custody, and anti-loss needs. In a world migrating long-term on-chain, AA is a structurally high-certainty investment direction; in a world where Rollup costs decline, it is a "future that can be realized"; in an internet coexisting with x402, it is the middle force shaping the on-chain account system.

IV. Conclusion

The core value of AA lies in completing the transition of Ethereum's account system from the primitive model of "private key = account" to the modern paradigm of "account = program." It fills a key missing link in the migration from Web2 to Web3, making a secure, recoverable, programmable wallet system possible. Although AA still faces structural bottlenecks like high costs, weak commercial closed loops, and cross-chain limitations, it has become the infrastructural direction for upgrading the on-chain experience. In the future, AA will exist long-term as a high-end account layer, not the sole standard; x402 will complement it with cross-chain and payment interoperability. Together, they will propel Web3 from the geek era to the mass era, laying the key cornerstone for a "unified internet account."